Economic Trucking Trends: Earnings diverge, spot market punishes

Two of Canada’s three publicly traded trucking companies reported Q1 earnings this week, with starkly different results.

Mullen Group posted record earnings and held its guidance. Murray Mullen, senior executive officer, said he hasn’t had to follow peers in lowering guidance because he took a conservative view of the year to begin with. The LTL business was strong, and results were buoyed by a resurgence in the industrial and specialized segment, which benefited from an increase in oil and gas drilling activity in Western Canada.

Mullen is not anticipating economic growth for the balance of the year. He told analysts that just walking through the company’s warehouses it’s clear there’s an inventory overhang. And, it’s the wrong type of inventory that’s sitting in warehouses. Mullen said manufacturers and retailers will have to work through this inventory through the remainder of the year before LTL trucking sees any meaningful increase in demand.

TFI International slashed its guidance by more than $1 per share (to $7) due to weakness, particularly in the U.S. Like its U.S. peers, TFI saw sharp reductions in freight volumes. It has about 800-900 employees on layoff and is offering early retirement packages. Meanwhile, the company is working to reach a contract with the Teamsters in the U.S.

The good news, however, is that TFI International has finished integrating IT systems from its purchase of UPS Freight in the U.S., giving its executives better visibility into costs and enabling better decision making. CEO and chairman Alain Bedard aksi hinted we could see a significant Canadian acquisition from TFI before the end of the year, and at least one smaller tuck-in much sooner.

Titanium will report its Q1 earnings May 15.

Spot market sour

Spot market rates in the U.S. slid further in March, despite an increase in volumes. The DAT Truckload Volume Index increased for van (10%), reefer (8%), and flatbed (23%) loads. However, it did little good for truckers chasing spot market freight, as national average rates for van and reefer loads plunged to two-and-a-half year lows in March.

“While shippers are taking advantage of the current situation to stabilize their carrier base and bring their contract rates back in line, the spread between spot and contract rates was historically large — 59 cents a mile for van freight, 57 cents for reefers, and 66 cents for flatbed freight,” said Ken Adamo, DAT chief of analytics. “We expect spot rates to remain at ‘touch-bottom’ levels until retailers start replenishing inventory for the end-of-the-year holidays.”

Rates this low on the spot market haven’t been seen since July 2020, DAT reports. How bad are they? Spot van rates averaged US$2.16 per mile in March, down 89 cents year over year. Contract rates were $2.75 a mile, down 12 cents.

Canada, not so bad?

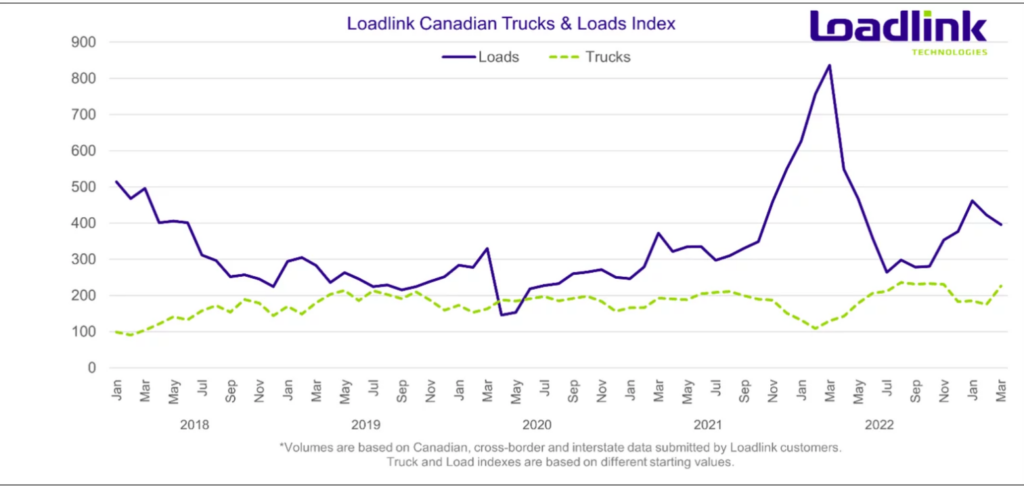

Here in Canada, spot market load volumes paint a mixed picture. Loadlink Technologies reported volumes down 6% in March from February levels, and 53% lower than last March. Truck postings, meanwhile, surged 29% from February, with 2.51 trucks posted on Loadlink for every available load.

Sounds bad. But there is reason for optimism. First-quarter load volumes on Loadlink were up 27% from Q4 2022, while truck postings fell 9%. Tough year-over-year comparisons make the volumes seem worse than they are, Loadlink reports.

“Year-over-year comparisons look vastly exaggerated as load volumes in Q1 2022 were record highs for Loadlink’s history,” the company said in a release. “Due to lifted Covid-19 pandemic restrictions and a reinvigorated economy, load volumes in February and March 2023 were almost double what they are currently. Despite that, Q1 2023 volumes still have been higher than all other months in 2022 since June onwards, so current freight market conditions should not be underestimated despite poor annual comparisons.”

Capacity rebalancing underway

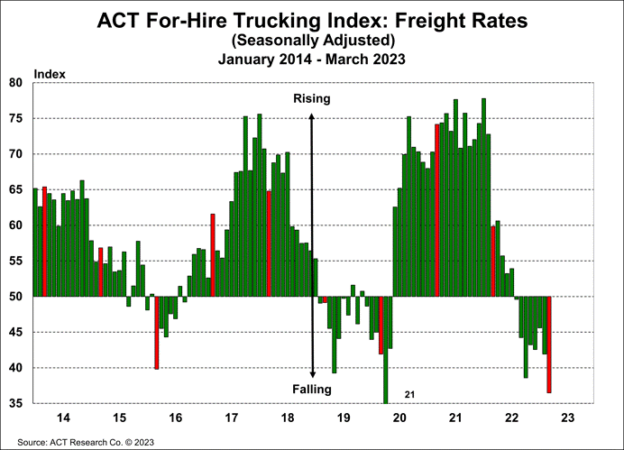

Industry analyst ACT Research reported improving overall freight volumes for March, but further declines in rates. Its For-Hire Trucking Index declined by less in March than it did in February, with volumes decreasing at a slower pace amid a market of mixed economic signals.

“A normal trucking freight cycle includes two-plus years of growth followed by about 18 months of retrenchment,” Tim Denoyer, vice-president and senior analyst at ACT Research said in a release. “The Volume Index has been below 50 for nine of the past 12 months. While the near-term outlook remains cautious, imports should begin to recover soon. If this cycle is like the last two, demand growth will return in 2024, perhaps even late 2023.”

In the meantime, the company’s Pricing Index continues to paint a grim picture, falling 5.4 points in March to the second lowest reading in the index’s history (above only April 2020).

“The cure for low prices is low prices, and with spot rates far below fleet operating costs, capacity is slowing,” Denoyer summarized. “While the pricing pendulum remains with shippers for now, we see signs that the next capacity rebalancing has begun. We think capacity is set to decline later this year, and rate trends should begin to recover as soon as traction on freight volumes is established.”

The last word

For this edition, we’ll give the last word to Mullen, who gave stock analysts a succinct overview of why trucking is coping with a freight recession, if not an economic one.

“A mismanagement of inventories is the single most important reason for last year’s freight surge and this year’s freight recession,” Mullen explained. “Inventories will be brought into balance and the freight recession will end.”

However, he added “the freight recession we are in is going to continue for a while yet in my view, because there’s not really a demand push and supply is remaining sticky.”